www.tax.ny.gov basic star exemption

In 90 of school district segments seniors receiving the Enhanced STAR credit save at least 10 more than those receiving the Enhanced STAR exemption. STAR is a tax relief program that lowers property taxes for owner-occupied primary residences.

Today Is The Last Day To Apply For Star Other Property Tax Exemptions In Ny Syracuse Com

Basic STAR and Enhanced STARBasic.

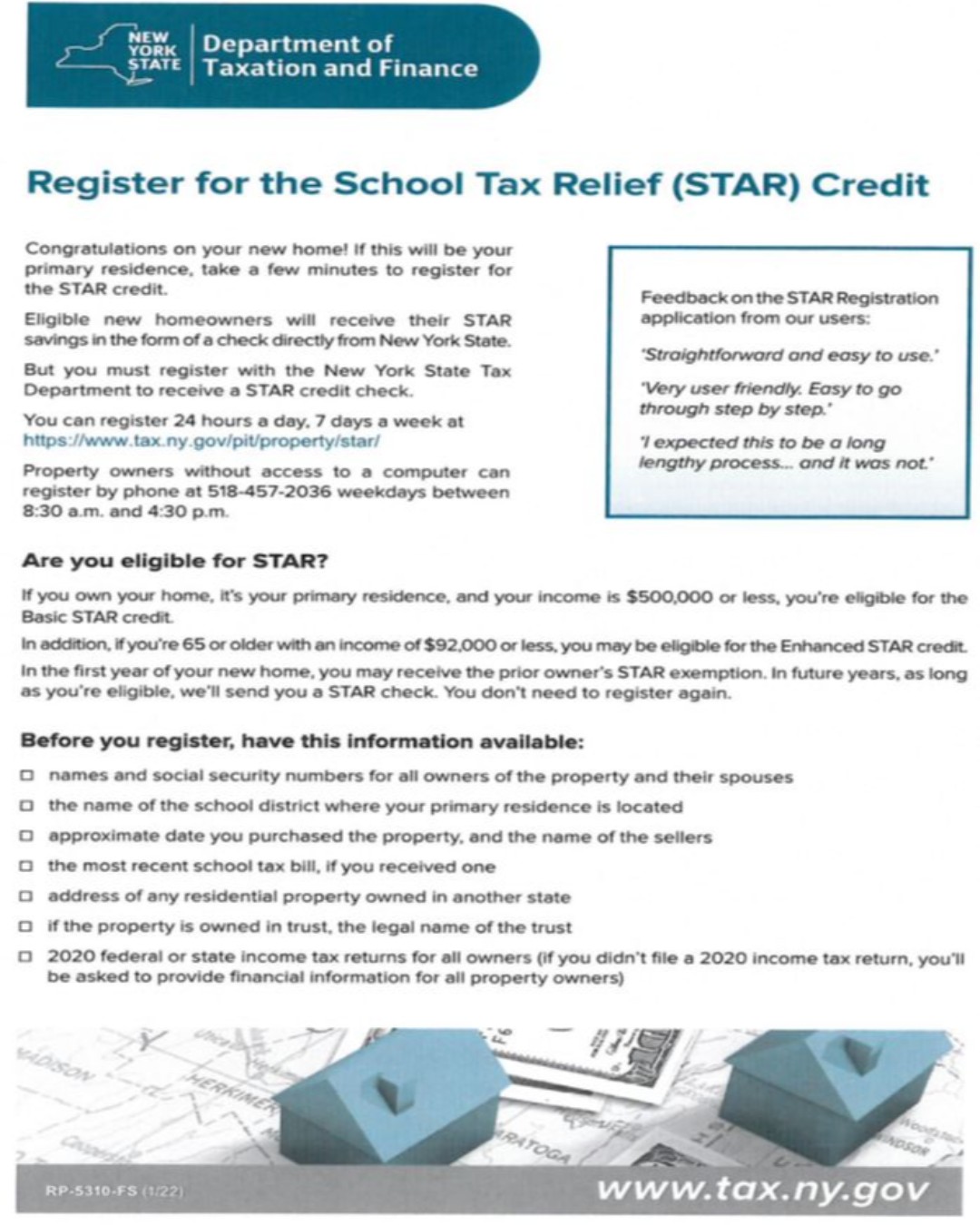

. To apply to STAR a new applicant must. BASIC STAR - The Basic. There is also a telephone number where a homeowner can call to ask questions and re-apply for the STAR Exemption.

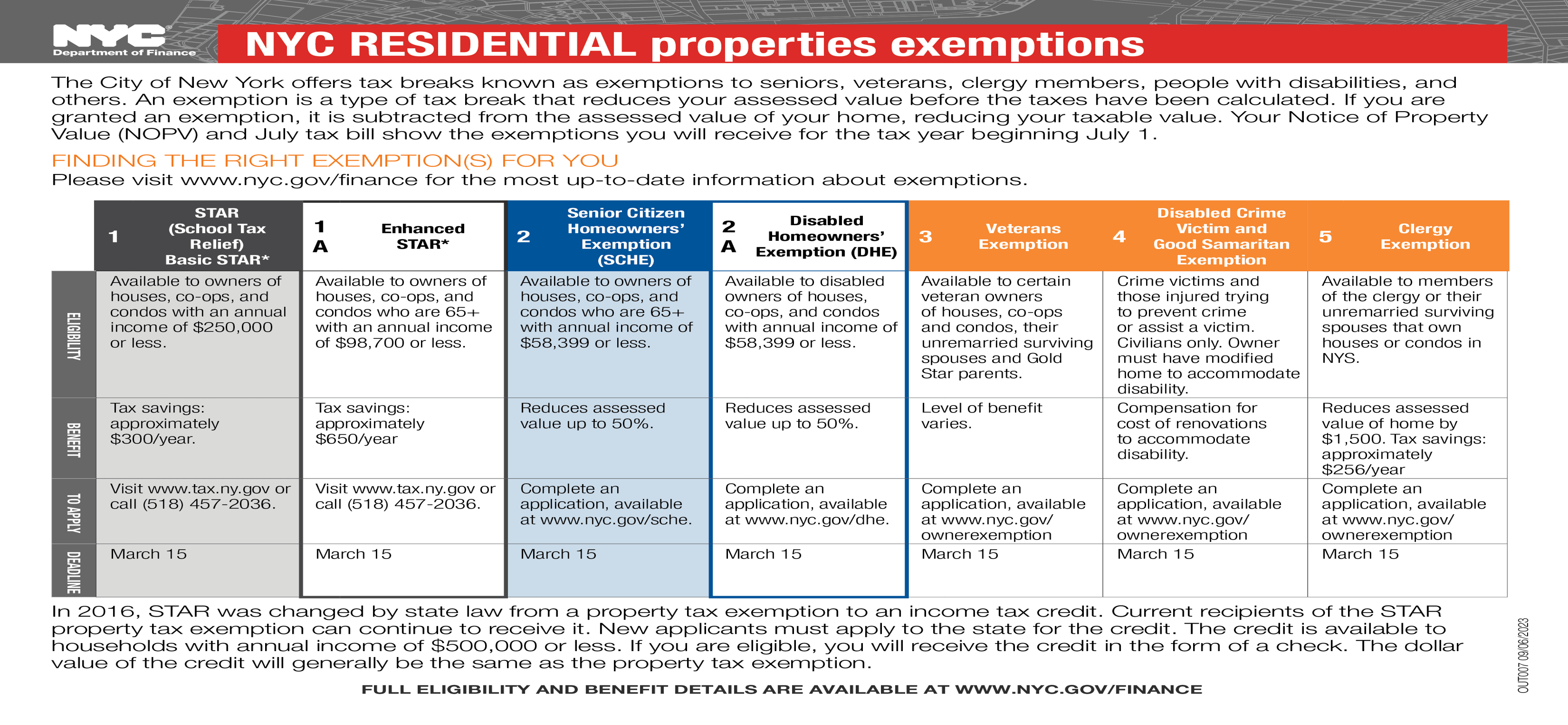

The STAR benefit applies only to school district taxes. Criteria are the same for both the STAR CreditCheck and the STAR Property Tax Exemption. The states STAR benefit in the form of an exemption reflected on a school property tax bill or a credit that comes as a check gives eligible homeowners a break on.

12 rows STAR School Tax Relief exemption forms. Star School Tax Relief Basic Exemption Available if you own and occupy a residential property with federally adjusted gross income under 500000. All applications are due by March 1 2023 for the 202324 December 2023 - November 2024 Tax Year.

There are two levels of STAR benefits. The following security code is necessary to prevent. You must file exemption.

In nearly 20 of the. Based on the first 74900 of the full value of a home for the 2022-2023 school year. You will have to apply for the exemption on your new primary residence.

The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as much as 2 each year but the value of the. Use Form RP-425 Application for School Tax Relief STAR Exemption available on the Tax Departments website at taxnygov or. The formula below is used to calculate Basic STAR exemptions.

When you purchase a new home your STAR tax exemption is not transferred automatically. To qualify the adjusted gross income must be under the State specified limit for the required income tax year 500000 for Basic 92000 for Enhanced and is eligible for a. 2023-2024 Enhanced STAR Property Tax Exemption Application FOR USE BY HOMEOWNERS WHO WERE ENROLLED IN THE STAR PROGRAM PRIOR TO JANUARY 2 2015 Nassau County.

The process to apply for a STAREnhanced STAR EXEMPTION has opened. It is important to note that any homeowner who does. There is no application needed for this exemption and will be based upon permit applications filed with.

Beginning with 2016 law requires any. It doesnt apply to. Page 2 of 2 RP-425-B 722 Instructions General information The Basic STAR exemption reduces the school tax liability for qualifying homeowners by exempting a portion of the value of.

You only need to register once and the. Based on the first. Under the law all new construction must be completed by January 2 2023.

Enter the security code displayed below and then select Continue. Register for the Basic and Enhanced STAR credits יידיש 한국어 The STAR program can save homeowners hundreds of dollars each year. Beginning in 2016 any homeowner who is applying for the first time on a property meaning you have NEVER had any STAR exemptions.

Basic STAR Exemption and Star ENHANCED Exemption. You may apply for the Basic STAR or Enhanced STAR tax exemption with the NYC Department of Finance if. You owned your property and received STAR in 2015-16 but later lost the benefit.

Tax Dept Says Most In Ny Have Registered For Basic Star Exemption

Regina Keenholts Coldwell Banker Prime Properties The Star Deadline Is Fast Appropaching Don T Miss Out On Great Tax Refunds For More Information Https Www Tax Ny Gov Pit Property Star Star Exemption Program Htm Facebook

Tax Collector Tax Assessor Town Of Lewis Ny

Kennedy And Ryan Urge Homeowners To Re Register For Basic Star Exemption To Save Hundreds On Taxes Ny State Senate

Register For The School Tax Relief Star Credit By July 1st Greene Government

Town Of Salina On Twitter Register For Basic Star Credit If Property Is Your Primary Residence Amp Income Is 500 000 Or Less Https T Co Svry6rjmdn Or By Phone Weekdays 8 30am 4 30pm 518 457 2036

02 16 2021 Assessment Community Weekly

The School Tax Relief Star Program Faq Ny State Senate

It 201 I Instructions New York State Department Of Taxation And

Basic Star Exemption Deadline Approaches

Deadline Coming Up For Seniors To Apply For Enhanced Star Exemption Wham